As dedicated pet owners, we consider our beloved animals to be cherished family members. This deep bond comes with a significant responsibility: ensuring their well-being even when we can no longer personally provide care. Establishing a Pet Trust is a proactive and legally sound method to guarantee uninterrupted care for your companion animals. This guide will explore the essential definitions and considerations surrounding pet trusts to help you determine if this planning tool is right for you and your furry family.

What is a Pet Trust?

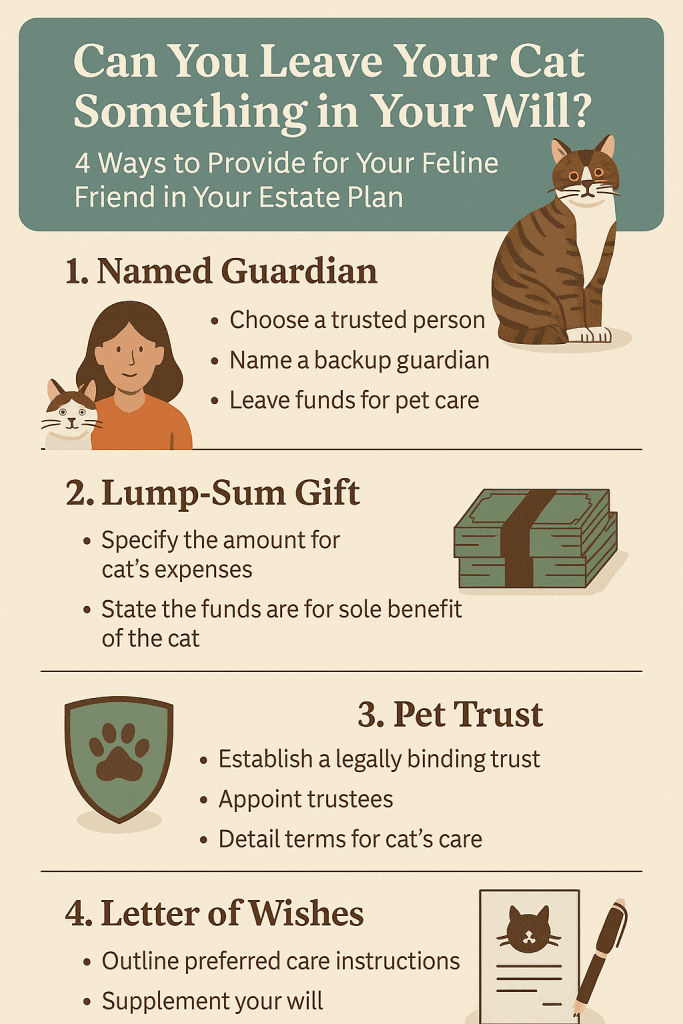

A pet trust is a legal arrangement designed to provide for the ongoing care and financial support of one or more companion animals. This trust can be activated either during your lifetime, in the event of your disability or incapacitation, or after your death. The individual creating the trust is known as the grantor. The trust typically designates a trustee who will manage the funds allocated for your pet’s benefit and disburse them to a named caregiver. For state-specific information, you can consult our State Laws Chart.

Why Consider a Pet Trust?

The legally enforceable nature of trusts offers peace of mind, assuring that your specific wishes for your pet’s care will be honored. Pet trusts allow for highly detailed instructions. For instance, you can specify a particular brand of food your cat prefers or mandate annual veterinary check-ups. A trust that takes effect during your lifetime can outline care instructions should you become ill, injured, or otherwise unable to care for your pet. Since you know your pet’s unique habits and needs best, a trust allows you to clearly define the standard of care they should receive and name the individuals willing and capable of providing it. This ensures continuity of care, mirroring the quality and love they are accustomed to.

Key Elements to Include in Your Pet Trust

When setting up a pet trust, you’ll need to provide comprehensive information to ensure its effectiveness. This includes naming a trustee and a successor trustee, as well as a primary caregiver and a successor caregiver. Beyond these crucial roles, consider the following details:

- Pet Identification: Clearly identify your pets. This can be done through photographs, microchip information, or DNA samples. Alternatively, you can define them as a “class” – for example, “all pets owned by me at the time of my death.”

- Standard of Care: Describe in detail the accustomed standard of living and specific care requirements for your pet. This includes diet, exercise, grooming, and any special medical needs.

- Oversight (Optional): If desired, you can stipulate that the trustee conduct regular inspections of your pet(s) to ensure their well-being and that the care instructions are being followed.

- Financial Provisions: Determine the amount of funds necessary to adequately cover your pet’s expenses according to their established standard of living. Specify how these funds should be distributed to the caregiver. It’s important that the allocated amount is reasonably required for the pet’s care.

- Trust Administration Costs: Allocate sufficient funds to cover the expenses associated with administering the pet trust itself, such as trustee fees.

- Remainder Beneficiary: Designate a beneficiary to receive any remaining funds in the trust should they not be fully exhausted by your pet’s care.

- Final Disposition: Provide clear instructions for the final disposition of your pet, whether it be burial or cremation.

For more in-depth information tailored to your location, please refer to our State Laws Chart.