For professional dog walkers, ensuring the safety of their canine clients and their business is paramount. While a well-behaved pup might seem harmless, unexpected incidents can occur, making robust insurance coverage a critical component of a successful dog walking venture. This guide delves into the various aspects of Dog Walking Insurance Prices, helping you understand the costs involved and what factors influence your premium.

Getting clarity on insurance costs can sometimes feel more complex than managing a pack of energetic retrievers. However, understanding the typical price ranges for different types of dog walking business insurance is crucial for budgeting and protecting your livelihood. Whether you operate as a sole proprietor or manage a small team, having the right coverage provides peace of mind. You might also be interested in the price for dog walking per hour to compare with your business expenses.

How Much Does Dog Walking Business Insurance Cost?

The cost of dog walking insurance can vary significantly based on the type of coverage and the provider. Many modern insurance solutions, like Thimble’s on-demand Dog Walking Insurance, offer flexible payment options, allowing you to purchase coverage by the hour, day, week, or month, rather than committing to a traditional annual plan. This flexibility can be particularly beneficial during periods of varying work schedules.

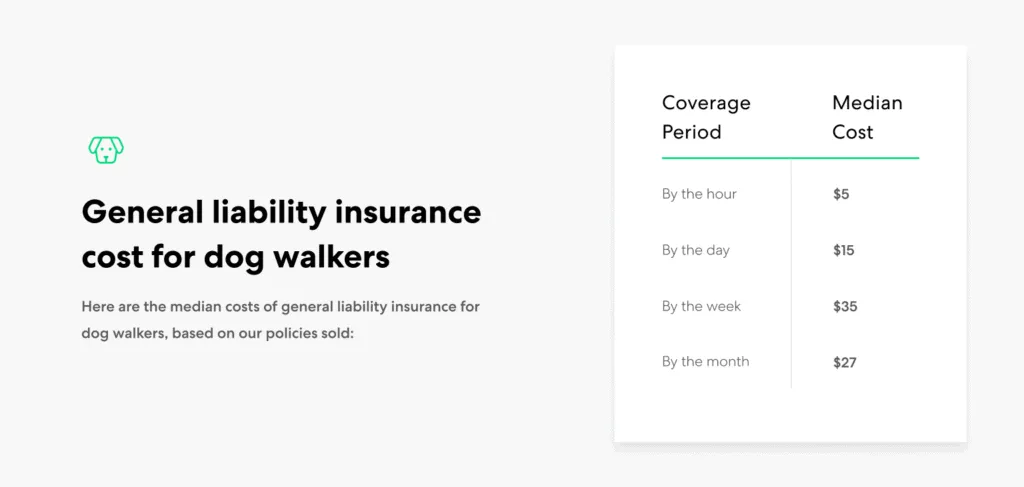

General Liability Insurance Costs for Dog Walkers

General liability insurance is a fundamental requirement for most dog walking businesses. It covers claims related to third-party bodily injury, property damage, and personal and advertising injury. Based on policies sold, here are typical median costs for general liability insurance:

- Per Hour: Approximately $5

- Per Day: Approximately $15

- Per Week: Approximately $35

- Per Month: Approximately $27

Median costs of general liability insurance for dog walkers

Median costs of general liability insurance for dog walkers

These figures provide a baseline for what you might expect to pay for essential protection. It’s important to remember that these are median costs, and your specific premium may differ.

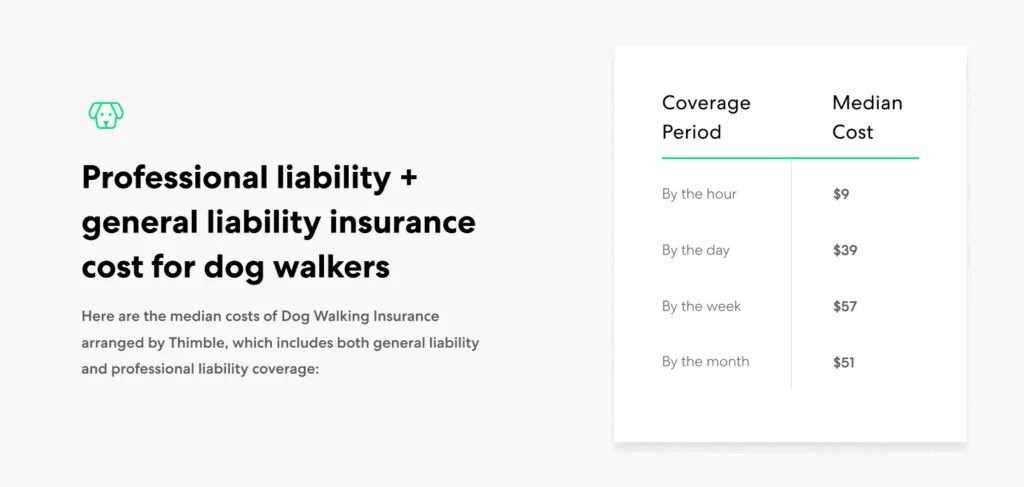

General Liability + Professional Liability Insurance Costs

For more comprehensive protection, many dog walkers opt for a bundle that includes both general liability and professional liability insurance. Professional liability insurance is crucial if you offer advice or services that could lead to a client’s financial loss, such as pet training or grooming advice. The median costs for this combined coverage are typically:

- Per Hour: Approximately $9

- Per Day: Approximately $39

- Per Week: Approximately $57

- Per Month: Approximately $51

Median costs of combined general and professional liability insurance for dog walkers

Median costs of combined general and professional liability insurance for dog walkers

Understanding these costs helps you budget effectively and decide on the level of protection that best suits your business needs. For more insights, you can also look into dog walking average price to compare your service fees with these insurance expenses.

Why Do Dog Walkers Need General Liability and Professional Insurance?

Even the most well-behaved dogs can be unpredictable, and accidents are an unfortunate reality when working with animals. Dog walking insurance isn’t just a safeguard; it’s an investment in your business’s stability and reputation.

General Liability Insurance: Protecting Against Accidents

General liability insurance shields your business from claims arising from common accidents that cause injury to a third party or damage to property. This includes:

- Third-Party Bodily Injury: If a dog under your care accidentally bites a passerby or causes someone to trip and fall, this coverage can help with legal costs and medical expenses for non-employees. It’s important to note that this generally does not apply to your own employees, for whom workers’ compensation might be needed.

- Third-Party Property Damage: Should a dog scratch a client’s antique furniture or damage property along your walking route, general liability can cover the investigation, defense, and settlement costs. However, it typically does not apply to animal injuries under your direct care unless explicitly offered as an add-on.

- Personal & Advertising Injury: This covers claims that you made damaging public statements or posts against a competitor, offering protection against libel or slander accusations.

Professional Liability Insurance: Covering Your Expertise

While primarily a dog walker, you might also offer related services like basic training tips or grooming advice. If your professional guidance inadvertently leads to a financial loss for a client, professional liability insurance steps in to protect your business. For instance, if you recommend a certain training method that a client claims caused harm or financial detriment, this coverage helps manage the associated legal and settlement costs. Many pet business owners also research pet sitting insurance reviews to ensure they have comprehensive coverage across all services.

A professional dog walker ensures the safety and well-being of their canine clients during outdoor excursions, mitigating potential risks with proper insurance coverage.

What Factors Affect Dog Walking Liability Insurance Cost?

Several variables contribute to the final cost of your dog walking liability insurance. Beyond the type of coverage you select, these factors help insurers assess the level of risk associated with your business:

- Your Location: Operating in more densely populated urban areas often carries a higher premium due to increased foot traffic and potential hazards compared to rural settings.

- Your Coverage Limits: Most insurers, including Thimble, allow you to choose between different liability coverage limits, such as $1 million or $2 million. Higher limits offer greater protection but come with a higher premium.

- The Size of Your Team: If you hire additional dog walkers or other employees, your insurance costs will likely increase to cover the added risk associated with more individuals representing your business. This is distinct from your canine companions, who are part of the insured activity.

- The Duration of Your Coverage: While on-demand policies offer flexibility, the total cost is influenced by the cumulative duration for which you need insurance throughout the year. Longer, continuous coverage periods might sometimes offer different pricing structures compared to intermittent, short-term policies.

These elements collectively paint a picture of your business’s risk profile, influencing how much you’ll pay to keep your operations secure. If you’re expanding your services, consider checking dog walking pet sitting insurance for integrated coverage.

Supervising a group of diverse dog breeds requires vigilance and comprehensive insurance to handle any unforeseen incidents effectively.

Other Types of Insurance for Dog Walkers

As your dog walking business grows and evolves, you might find that other types of insurance become necessary to provide a full spectrum of protection.

Auto Liability Insurance

If your dog walking business owns a vehicle used for transportation, commercial auto insurance is almost always required. However, if you only use your personal car to travel to and from client locations, your personal auto insurance might suffice. It’s always advisable to consult with your auto insurance provider to ensure you have adequate coverage for business-related driving. Neglecting this aspect can lead to significant financial risks.

Workers’ Compensation Insurance

Should you expand your team by hiring employees to help manage your growing roster of canine clients, workers’ compensation insurance becomes a legal necessity in many regions. This coverage protects your employees in case of workplace illnesses or injuries, ensuring they receive medical care and lost wages, while also shielding your business from potential lawsuits. Understanding this can contribute to planning your annual dog expenses more accurately for your business.

A professional dog walker organizing their essential gear, including multiple leashes and waste bags, before starting their rounds.

Keep Those Tails Wagging with the Right Protection

Arriving at a client’s home, you want to feel confident that you’re not just providing a valuable service but also that your business is fully protected against the unpredictable nature of animals. While you can’t control every wag or unexpected chase, you can control the security you provide for your business through comprehensive insurance.

- General liability insurance for dog walkers typically ranges from $5 per hour to $27 per month, offering foundational protection against common accidents.

- Bundled general and professional liability coverage, providing more extensive protection, generally ranges from $9 per hour to $51 per month.

- As your business expands, additional types of insurance like commercial auto or workers’ compensation can be added to fortify your coverage.

A cheerful dog engaged in a game of fetch with its owner, highlighting the joy and activity that proper care and attention can bring.

With flexible, on-demand insurance options, getting the right coverage can be as quick and easy as teaching a good boy to fetch. You only pay for the protection you need, when you need it, ensuring that your business remains as agile and responsive as your best-behaved client. Take the lead in protecting your dog walking business by exploring insurance options today, ensuring peace of mind for both you and your furry charges.