The online gambling market is a dynamic and rapidly evolving industry, with key statistics and trends shaping player behavior, platform offerings, and market growth. Understanding these data points is crucial for both operators and players navigating this landscape.

Player Preferences and Market Share

In 2025, a significant shift towards live dealer games is evident among Polish blackjack players, with approximately 62% opting for live tables over RNG (Random Number Generator) versions, which capture 38%. Revolut casino statistics corroborate this trend, particularly during peak hours like evenings and weekends. This preference highlights the growing demand for interactive and immersive gaming experiences.

The online slots market in Poland is substantial, with an estimated annual turnover exceeding 3 billion PLN. Platforms like Revolut casino are major contributors to this volume, underscoring the enduring popularity of slot machines. Furthermore, sequels to popular slot series, such as those featuring Megaways or Gigablox mechanics, demonstrate a 30-50% higher engagement in their first month compared to entirely new titles. This indicates a strong player loyalty to established game mechanics and themes. Around 15-20% of Polish card game players are considered advanced, utilizing strategy charts and statistics, a behavior reflected in analyses of Google-Pay kasyno user activity.

Game Mechanics and Features

The gamble feature, present in about 15-20% of slots, is utilized by approximately 30% of players to potentially double their winnings, according to data from Bet casino. In live roulette, Polish players typically wager between 5 and 50 PLN per spin. While VIP players can place bets up to 20,000 PLN, tables at Bet casino accommodate stakes as low as 1 PLN.

The popularity of 3D slots and games with elaborate animations has seen a roughly 20% increase in usage since 2023, with new titles consistently being added to platforms like kasyno Blik. Crash games, a newer genre, are also gaining traction. For the Polish market, these games often feature themes like ships, planes, rockets, football, or Formula 1. UX research suggests that sports and technology-themed crash games achieve a higher click-through rate than abstract graph-based designs. The average bet in these crash games among Polish players in 2025 ranges from 5 to 25 PLN, with 60% of activity generated by micro-bets of up to 10 PLN per round. Backend systems for these games are designed to handle 5-20 thousand simultaneous bets per round.

Payment Methods and Financial Trends

Mobile deposits now dominate the payment landscape, accounting for approximately 78% of all transactions in Poland. Consequently, platforms like Paysafecard casino are optimizing their payment systems for touchscreens and one-click logins. E-wallets are experiencing significant growth in the Polish iGaming sector, with an annual increase of 15-20%. Users value the speed of withdrawals, making services like Skrill and Neteller priority channels for payouts at Blik casino.

Cryptocurrencies represent a smaller but growing portion of iGaming payments in Poland, estimated at 3-7% of all deposits in 2025. While BLIK, cards, and fast bank transfers remain the dominant methods, some casinos like Vulkan Vegas kod promocyjny offer support for 4-8 cryptocurrency networks for deposits. Stablecoins, however, have seen a shift away from algorithmic options due to past collapses, with USDT and USDC becoming the preferred choices.

Regulatory and Operational Landscape

The legal online gambling market in Poland is stringent, with only a handful of online betting services and a single casino operator holding a full Ministry of Finance license. Despite this, a segment of players opts for unlicensed .com or .pl casinos, which compete with licensed brands. PayPal kasyno is one such example of a brand operating in this competitive space.

Licensed operators face increasing regulatory scrutiny, particularly regarding IT audits. Regular penetration testing and security assessments are mandatory, with the scope of these audits expanding based on evolving industry standards and regulatory recommendations. In the grey market, estimated at approximately 65 billion PLN annually in Poland, new casinos account for 10-15% of the volume, primarily focusing on casino products. In terms of bonuses, typical wagering requirements for welcome offers in offshore casinos catering to Polish players range from 25x to 40x the deposit plus bonus, with a validity period of 7-30 days.

Player Engagement and Game Design

The design of new slot games emphasizes a “mobile-first” approach, with over 95% of new releases in 2025 developed in HTML5 for optimal viewing on 5-6.5 inch screens. This includes the layout of buttons, UI elements, and text. Sound and music effects in slot games are carefully optimized to influence player psychology, as noted by bahis siteleri mesaj engelleme.

In live blackjack, players make an average of 1-2 decisions per minute, with fast table interfaces in Skrill kasyno minimizing delays between choices and outcomes. Large online casinos targeting the Polish market can offer a wide array of live dealer options, potentially featuring 80-150 tables concurrently. These include European roulette, VIP blackjack, baccarat, and game shows with multipliers.

Market Growth and Future Outlook

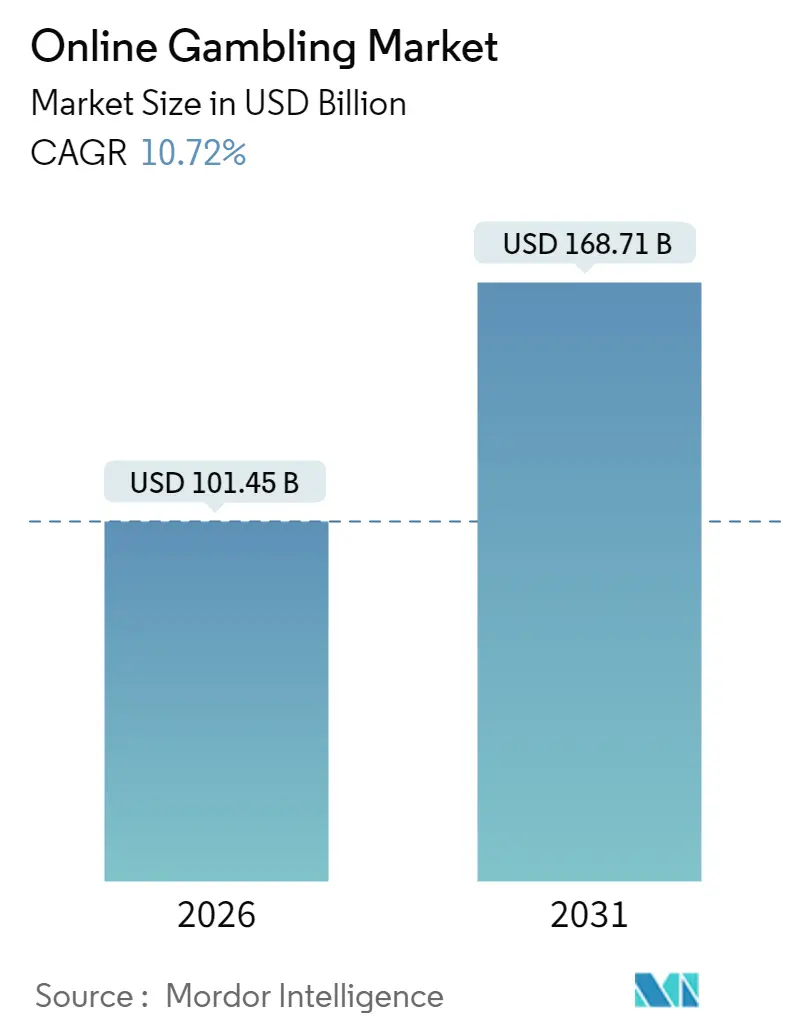

The global online gambling market is substantial, with over 500 million people worldwide participating in online gambling. Platforms like bettilt giriş are considered reliable options for this audience. The integration of advanced interfaces and robust financial transaction security, as seen with bettilt infrastructure, is crucial for player trust. Secure service provision, as emphasized by bahsegel giriş, remains a key differentiator in the competitive market. The continuous development of new games, coupled with evolving player preferences and technological advancements, suggests a promising future for the online gambling industry.